Transform your business with Odoo: the all-in-one ERP that grows with you

Are you looking for a complete solution to manage your business? With Odoo, you can integrate all areas of your company into a single platform: sales, finance, inventory, CRM, e-commerce, HR, and much more. Everything is 100% customizable and tailored to your needs.

Localized Global Accounting System

Automate and generate reports easily, integrate all your processes with accounting, and avoid tedious tasks while complying with the regulations of your country at all times.

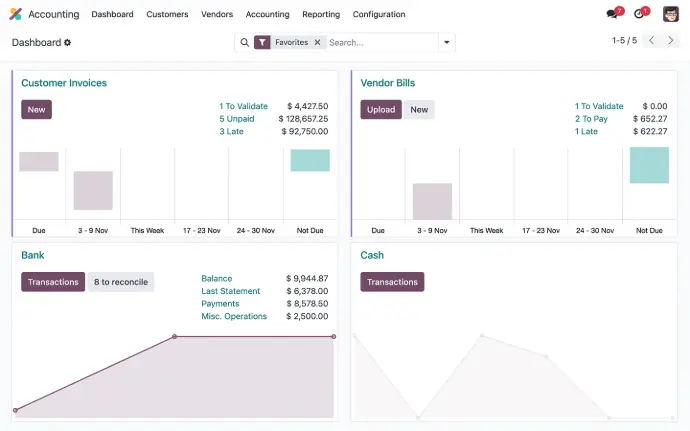

📘 Accounting in Odoo: simple, integrated, and automated

The Odoo Accounting module allows you to manage all your finances clearly and efficiently. Automate tasks, integrate information from across the company, and provide real-time reports for quick decision-making.

Main advantages

- Automatic bank reconciliation

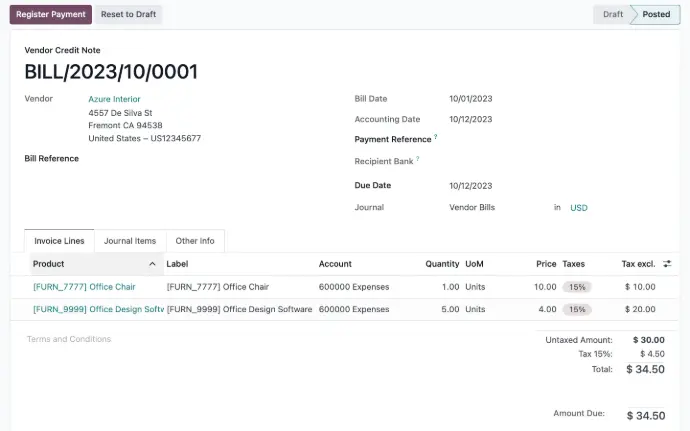

- Integrated invoicing

- Real-time accounting reports

- Integration with sales, purchases, inventory, and POS

- Modern and user-friendly interface

- Compatible with the accounting needs of Argentina

With Odoo, your accounting becomes more organized, faster, and more accurate.

Integrate all your accounting

Manage all your accounting processes from electronic invoicing, financial reports, tax books, types of tax documents, taxes, tax positions, integrations, and even Human Resources and payroll.

Everything on a single platform in a simple and integrated way for all your business processes.

Comply with ARCA

Our accounting localization complies with ARCA regulations so you can have peace of mind that all your processes are governed by Argentine regulations.

Financial statements such as the income statement, tax books like the purchase and sales book, bank reconciliation, taxes such as withholdings, and more with our development.

Automate your processes

Avoid tedious tasks and automate your entire accounting process such as cash and petty cash management, withholding management, physical inventory of fixed assets, cost allocation for imports, and more.

All of this integrated into all areas of your company such as purchasing, sales, inventory, accounting, human resources, production, projects, marketing, among others.

📘 Odoo Accounting: the simplest and most modern way to manage your finances

The module ofOdoo Accountingis one of the most complete and powerful tools in the system. It is designed so that any company—from SMEs to large organizations—can manage financesquickly, orderly, and without complications.

✅ Total automation

Odoo reduces manual work thanks to:

- Automatic bank reconciliation

- Integrated electronic invoicing

- Entries automatically generated from sales, purchases, and payments

- Automatic debt reminders

Fewer operational tasks, more time for important decisions.

✅ Real-time financial reports

Access to:

- Balance

- Income statement

- Cash flow

- Custom reports

Everything updated instantly with clear graphs for quick and accurate decision-making.

✅ Complete integration with the entire company

Accounting is automatically fed from:

- Sales

- Purchases

- Inventory

- POS

- Subscriptions

- Projects

No external spreadsheets, no manual errors, no duplicated work.

✅ Compatible with Argentina

With the right localizations and developments, Odoo allows:

- AFIP invoicing

- VAT books

- Perceptions and local taxes

- Accounting export

- Bank integration

Perfect for operating 100% within the Argentine regulatory framework.

✅ Easy, intuitive, and organized

Unlike other rigid and complex accounting systems, Odoo offers:

- Modern interface

- Clear menus

- Simple workflows

- Low learning curve

The accountant and the administrative team quickly adopt it.

✅ Accounting that grows with your business

Odoo is fully scalable. You can start with the basics and add:

- Budgets

- Fixed asset management

- Multi-currency

- Multi-company

- Accounting consolidation

Always integrated and without losing data.

Localization Argentina.The Argentina localization package includes:

Complete chart of accounts, according to your tax responsibility in ARCA. It can be used directly or modified according to your company's needs.

Report on VAT Purchase and Sales Books.

IIBB report by jurisdiction.

Integration with electronic invoice web service, invoicing in all types of allowed tax documents, from "Invoice A", "Invoice B" to "Electronic Credit Invoices MiPyMEs (FCE)" and Fiscal Controllers.

Integration with SmartButtons (check customer balances, scheduled activities, budgets, sales, purchases, meetings).

Integration with ARCA Webservices taxpayer database to automatically update tax information of contacts.

Integration with ARCA Webservices APOCRIFOS taxpayer database for automatic control of contacts.

Incorporation of Tax Exemption Certificates for each customer/supplier.

QR Code on invoices.

Obtaining ARCA USD rate / ARCA EUR rate for electronic invoicing.

Control of issued invoices ARCA.

Control of supplier invoices ARCA.

Calculation of withholding for Income and special regimes (Invoice M).

Calculation of IIBB withholdings.

Registry of IIBB Collection Agents BSAS.

Registry of IIBB Collection Agents CABA.

Automated perception calculation.

Digital VAT Book.

Mandatory tax reports: SIFERE Income, SIFERE Withholdings, SICORE Withholdings, ARBA Income, ARBA Withholdings, SIRCAR.

Mandatory IGJ reports: Subdiaries VAT Purchases and Sales, Daily ledger of accounting entries.

Electronic Invoice Export.

Delivery note with COT.

Internal taxes.

Leave us your inquiry