PROCEDURE. LAW No. 27,743. TITLE VII - CONSUMER TAX TRANSPARENCY REGIME. ISSUANCE REGIMES OF RECEIPTS. GENERAL RESOLUTIONS Nos. 1,415, 3,561, and 4,291. AMENDING AND SUPPLEMENTARY REGULATION.

Full text of the regulation: https://www.argentina.gob.ar/normativa/nacional/resoluci%C3%B3n-5614-2024-407183/texto

Odoo Update

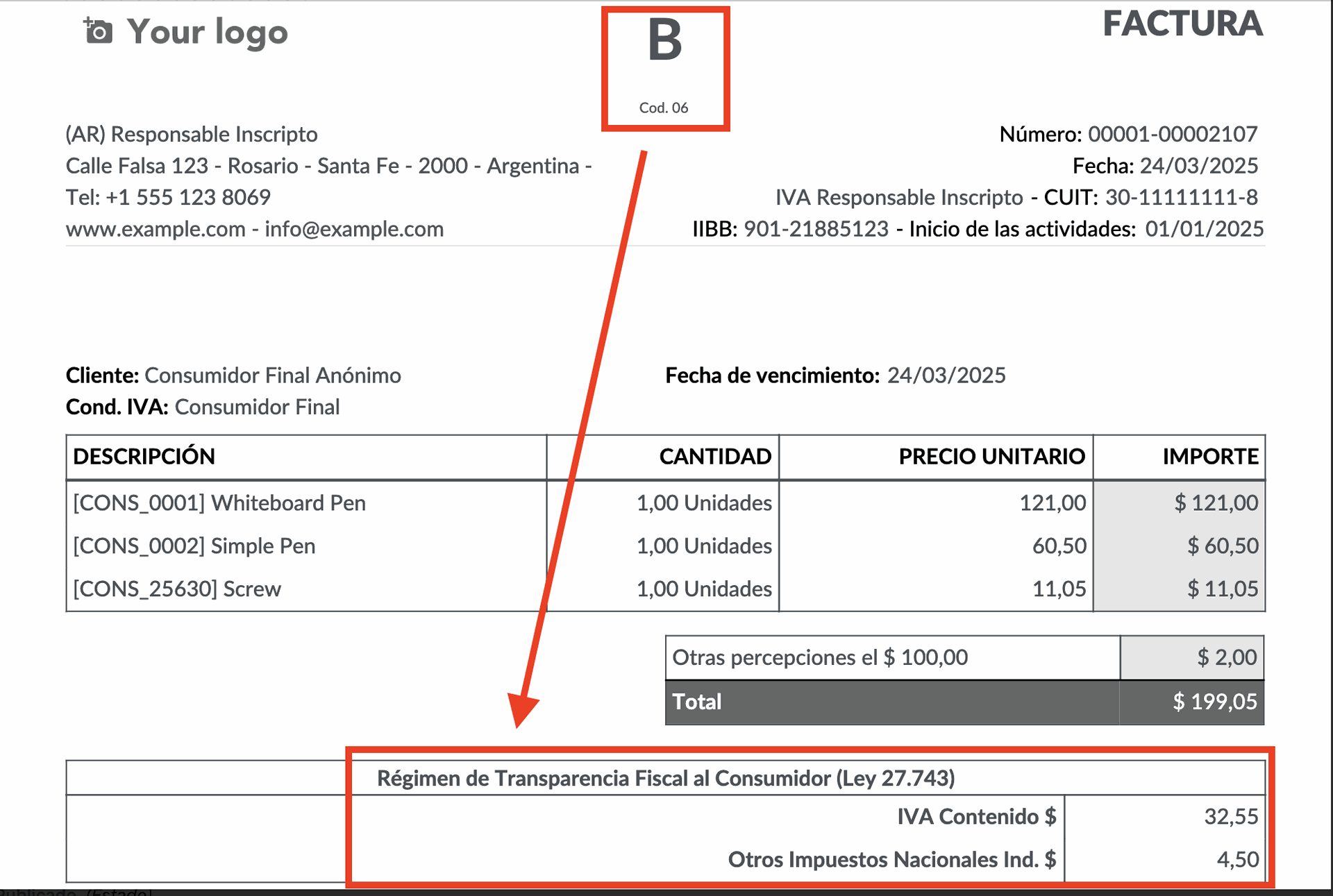

As of April 1, 2025, General Resolution 5614/2024 comes into effect. This regulation requires that invoicestype B include a breakdown of VAT and other National Indirect Taxes.

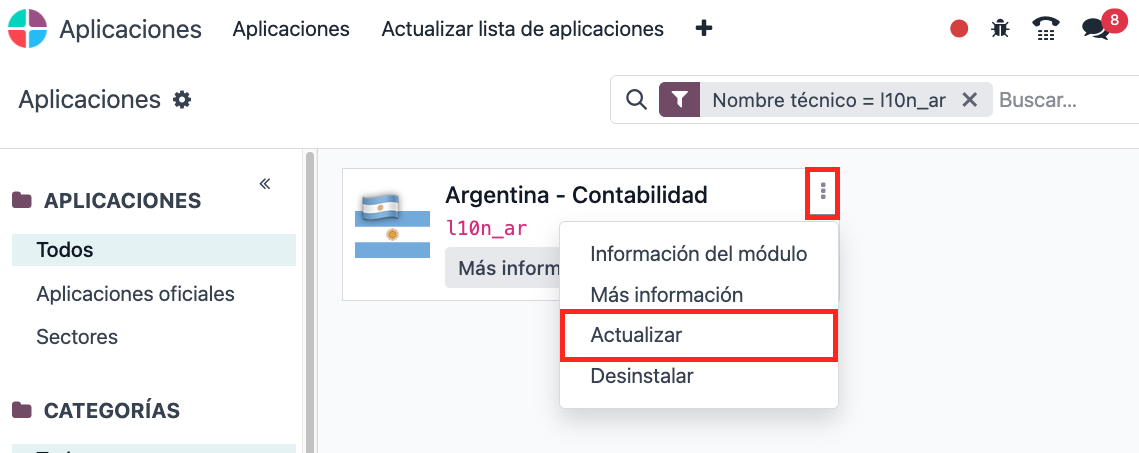

To access this new functionality inOdoo v16, v17, v18+,(Currently supported versions) it is enough to update the base module of the localization (l10n_ar)

Once the base module of the localization is updated, all regulations will be updated and ready to use.

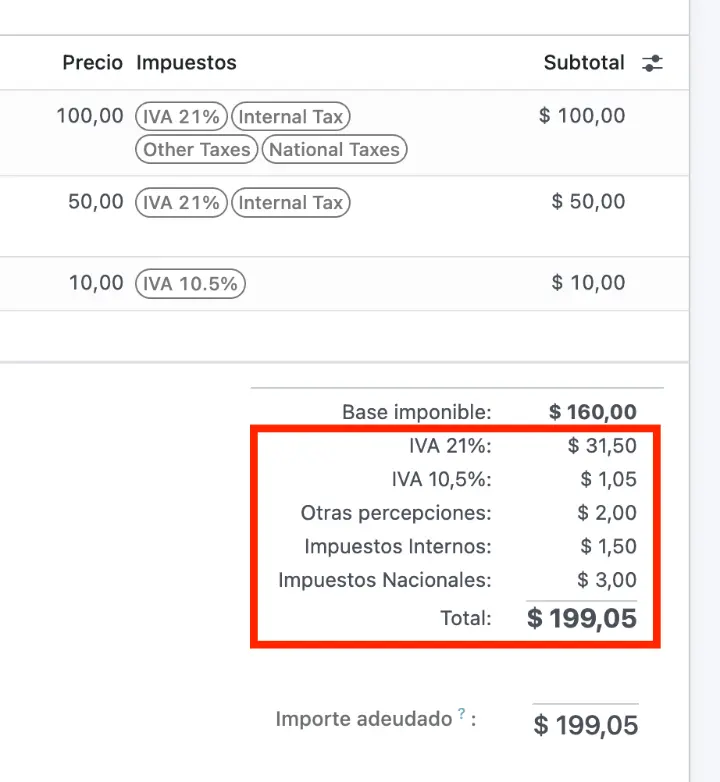

To verify the operation, we can create in the test environment, an invoice to Anonymous Final Consumer (Type B Invoice) and within the lines specify various taxes.

In addition to the table we have always used for the breakdown of taxes, within the PDF of our invoice we will find the breakdown related to the Consumer Tax Transparency Regime (Law 27,743)

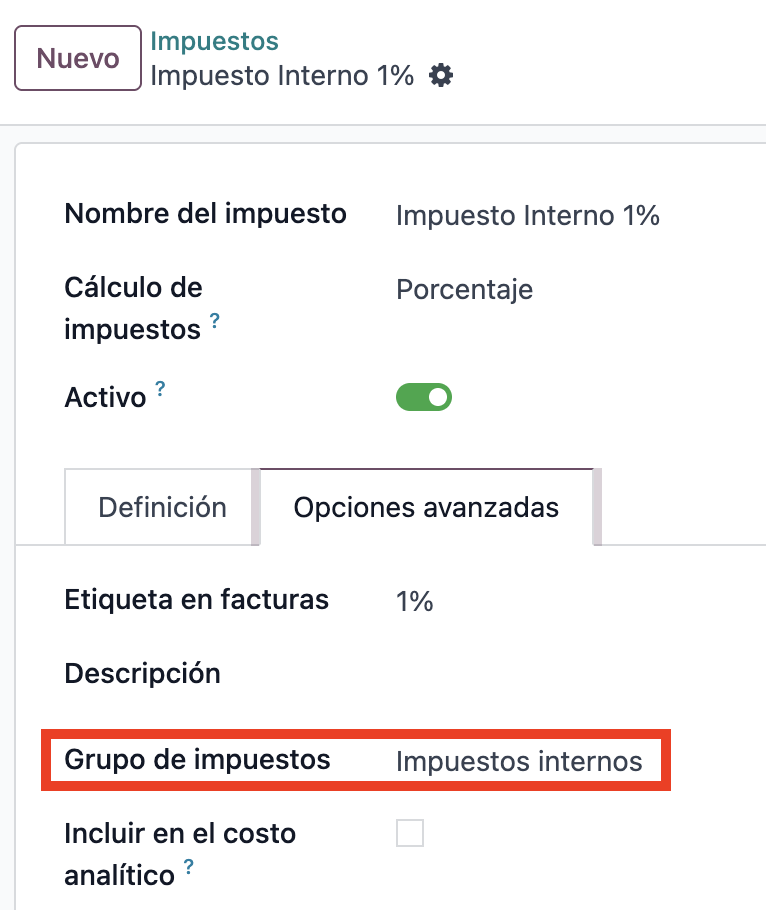

It is important to consider that this functionality is due to the configuration of "Tax Group" within each Sales tax.

To verify this configuration we need to go to the menu of"Configuration > Taxes > Select a tax of type "Sale" > Advanced Options"